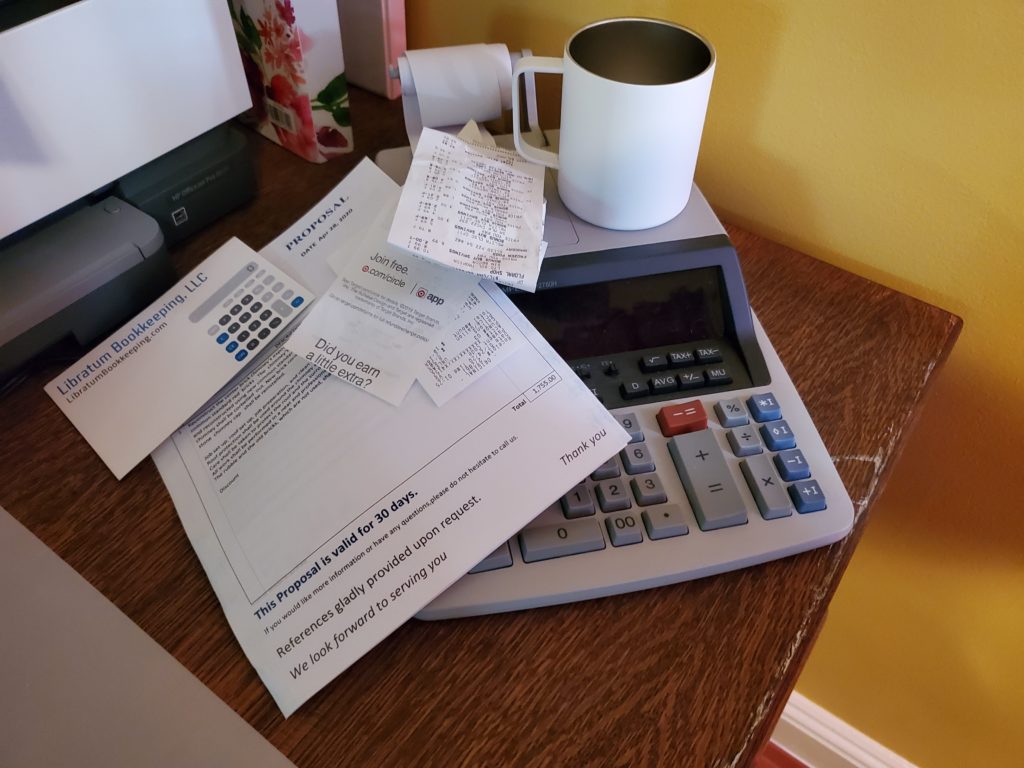

Expense receipts don’t seem that important. At least not until the pile leans so far over that it needs a windbreak. And no, a shoebox is not a good idea.

That pile of receipts just gets bigger and less appealing. The bigger it gets the less you want to deal with it. And just to make it worse, now you can’t remember the details. Was that an office supply or a gift for a customer?

Or is that a receipt for a personal expense? If you’re like most business owners, you sometimes use the wrong credit card; it happens. You don’t want to be sorting this out at tax time with your tax preparer. Remember last year?

Did you really record all of your travel expenses? Check your wallet for that meal you had on the way home. Was the benefit of this trip worth the expense? Timely bookkeeping will help you to make better decisions for your business.

Make next year’s tax season a breeze. Hire a bookkeeper. Email your receipts, and let me take care of recording the information and keeping copies of all your receipts. You and your tax preparer will be a lot happier.