Your profit and loss should be set up for you. The list should be understandable and organized so that you can understand it easily.

Your categories should be understandable to you. No secret codes here. And no doubling up, either. If you accidently list the same category (account) twice, then hide one of them. The software won’t allow you to delete an account; but you should be able to hide it so that it doesn’t get used.

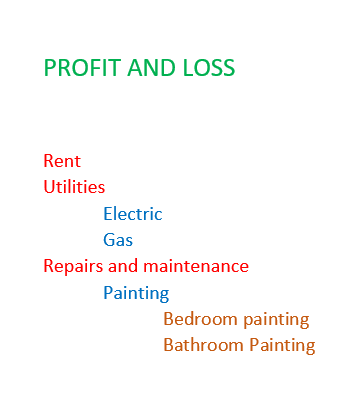

Grouping similar accounts will improve your Profit and Loss (Income Statement). It’s like an outline. For instance, maybe you painted 2 rooms and would like to have each room listed separately. Simply make each room a subheading under the heading “Painting”. So, the subheadings would be “Bedroom painting”, “Bathroom painting”, etc. Most software will allow more than one layer of subheadings, meaning that you can have subheadings for your subheadings, indenting more than once on the report.

You should order the list of accounts on your Profit and Loss in a way that simplifies the report. We do this by applying account numbers; the report will print in number order. We use certain numbers: 1000s are for assets; 5000s are for COGS. That’s why the numbers look so crazy.

Nobody likes to see all those weird numbers down the left side of the page. So, I don’t show them on the statements. In my opinion they don’t belong on the statements given to the business owners. But they lurk in the background; organizing the list of accounts; making the statements pretty; improving the chances that you will want to look at the reports.

Have fun! And be nice to your bookkeeper!

Need a bookkeeper? Click here to schedule a consultation